Onx Homes Launches Latest Plant in Quest To Accelerate Construction Process

Outlet: CoStar News

Published on April 9, 2024

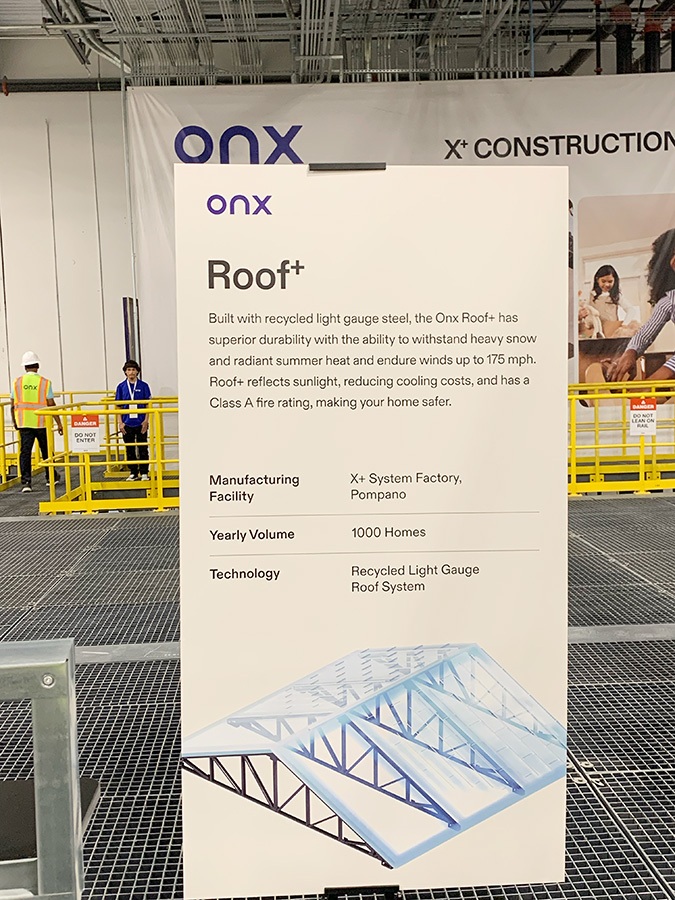

The factory floor is spotless, with no signs of use. But across the building’s expansive area, machines stretching as high as two stories are hard at work, some cleaning, others pouring concrete into rectangular molds. Elsewhere Onx Homes workers prepare lightweight steel for roofs as the bones of a new house take shape.

The plant, the company’s latest, is not only making single-family houses. It’s automating the process in order to build them much faster.

The 150,000-square-foot X+ Systems site, named after the proprietary building materials and technologies used by the homebuilder and developer, is roughly 30 miles north of downtown Miami and the company’s second such plant of three. The first, located in Miami-Dade County, builds the foundations for homes that span from just under 2,000 square feet to 4,000 square feet. Onx Homes has another factory in the works in Georgetown, Texas, just north of Austin.

The new Florida factory, in Pompano Beach, is automated and produces the walls, roofs and finishes that make up the homes found in Onx Homes’ neighborhoods. As production ramps up, the factory is expected to produce the necessary parts to build 1,000 homes each year, or enough for four homes every day. The lengthiest part of the process is waiting about 72 hours for the concrete to cure before final assembly at the development site.

The faster production comes as studies show the United States faces a shortage of housing that developers of both freestanding residential and multifamily properties are looking at profitable ways to fill. While the automation process is in its early days, proponents have said that innovations in construction of one type of building can provide a basis for the eventual application to other kinds of properties.

Co-founded in 2021 by CEO Ash Bhardwaj and a team with backgrounds in the real estate and technology industries, Onx Homes is a homebuilding startup aimed at reducing the time it takes to build a home to tap the need for housing across the country. The goal is to make housing more affordable by automating and simplifying as much of the construction process as possible.

Right now, it takes Onx Homes about 60 days to build a house, but the company is aiming to bring that time down to 30 days with the new factory. Rather than the average eight months and 22 subcontractors it takes to build a traditional house, Bhardwaj aims to have most of the structural work on his company’s homes done without that many subcontractors.

“Manufacturing is not easy. It requires a different level of skillset in the sense that every day you’re going to come to work to see how you can make it better, how to automate it,” Bhardwaj told CoStar News during a recent tour of the Pompano Beach factory. “The problem in the industry has been” that the big homebuilders are still building the traditional way with wood-frame houses that take nine to 12 months to build, Bhardwaj said.

Onx faces challenges. As the technology develops, innovation by rivals could overtake the company. Buyer preferences are hard to predict, and the new product may not prove as popular. If it does, much larger rivals could adopt similar techniques and use their bulk buying power to squeeze out lower costs.

Even so, the company’s portfolio now includes more than 5,000 homes across Florida and Texas under various stages of development. These homes are built using factory-made parts before being assembled on-site in a neighborhood developed by Onx Homes. In Florida, Onx Homes has 500 houses already built and lived in, according to Bhardwaj.

Modular construction “holds potential for market share gains in the years ahead,” Danushka Nanayakkara-Skillington, assistant vice president for forecasting and analysis for the National Association of Home Builders, said in an analysis from September 2023.

Need for Speed

Onx Homes, headquartered in Carrollton, Texas,is not the only company trying to build houses faster. There are at least 20 companies that make manufactured homes, from local players to national builders, listed as members on the website of the Florida Manufactured Housing Association, an advocacy group with over 700 members. Onx Homes is not on the list.

Another player working to marry the speed of technology with the need for new homes is Icon, a company looking to take 3D-printed housing mainstream. Icon made thenation’s first 3D-printed, single-family homes that were offered for sale in Austin, Texas, in 2021.

At the same time, traditional homebuilders are watching to see if companies such as Onx Homes will be successful before deciding whether they should advance their own modular and prefabricated housing plans.

For Onx Homes, there’s plenty of pressure, as members of the company’s leadership team know from prior experience. Bhardwaj and other Onx execs formerly worked at Katerra, a SoftBank-backed multifamily construction startup that aimed to reducebuilding costs byproviding modular construction and other technologies as a service. Katerra, after a severe liquidity crisis, filed for Chapter 11 bankruptcy protection in 2021 with plans to sell its assets and wind down operations.

Whereas Katerra tried to sell multifamily construction services to developers,Onx is singularly focused on developing homes on land it owns.

“If you want to enjoy the best margins, you have to control your own destiny, which means you have to be a homebuilder yourself,” said Bhardwaj.

While manufactured homes have been around for decades and can be built within a few weeks or even days, they’re often small in size. Floorplans listed on FMHA’s website generally range from slightly over 1,000 square feet to about 2,000 square feet, with a few exceptions. The houses, thanks to their semi-permanent nature, depreciate like a vehicle would and are regulated by Florida’s Department of Highway Safety and Motor Vehicles because of their mobility.

Modular homes, more similar to what Onx builds, are built piecemeal at factories before being put together at the development site. According to the Modular Home Builders Association, a national advocacy group, a modular house can take between six and nine months from construction to occupancy in a process that is only slightly quicker than traditional building methods. Onx Homes builds houses that typically range from 2,000 square feet to 4,000 square feet, Bhardwaj said. Prices for a smaller 1,791-square-foot model begin in the low $300,000s, according to the company’s website.

Nationally, the country needs more housing, both for sale and for rent. As housing costs continue to rise, more would-be buyers end up renting and driving up rental costs. The country faces a deficit of 3.7 million apartments to meet new demand, according to a 2022 report from the National Multifamily Housing Council. Florida, Texas and California accounted for 40% of future demand, requiring 1.5 million apartments.

According to the NAHB, the total number of homes built using modular or panelized construction came in at just 2%, or 26,000, of the 1.02 million homes completed in 2022.

Target Markets

Future demand in states such as Florida, Texas and California marks an opportunity for Onx Homes and other non-traditional homebuilders.

“We know Texas and Florida have a shortage of homes. This is a big market spot because of that,” Bhardwaj said.

In South Florida, migration from other parts of the country since the pandemic hit has led housing prices to surge, and the median sales price for a single-family home reached $650,000 in February, up 17.1% from last year, according to the Miami Association of Realtors. The number of cash buyers, a metric indicative of purchases insulated from the squeeze of higher interest rates as buyers avoid financing, increased 17.5% in February compared to last year in Miami-Dade County.

The reduced labor costs from faster factory construction translate into savings for the buyer. According to the company’s website, Onx Homes’ houses range from about $300,000 to $600,000, depending on the model and neighborhood.

“We focused on how to save,” said Bhardwaj. “And at the same time, how to get technology and scale to meet. I think companies like us are the future of our building industry,” Bhardwaj said.

One of the challenges for Onx Homes is that traditional homebuilding methods and companies have remained remarkably consistent and successful for decades. The country’s two largest homebuilders, Lennar and D.R. Horton, each recorded more than $34 billion in revenue last year.

Still, Bhardwaj thinks the pendulum is swinging in favor of companies like his. “The taste of the nation is changing from traditional homes to more modern homes. We see that as an opportunity,” he said.

Built to Last

The states benefiting the most from migration patterns since the pandemic, like Florida and Texas, also deal with a combination of hurricanes, wildfires and flooding that makes insuring and maintaining a home more expensive.

Houses made by Onx Homes are designed to exceed Miami-Dade County building codes, some of the strictest in the nation. The region, known for its hurricanes, often gets strong winds, rain and flooding even outside hurricane season. If Onx Homes can build a strong, sturdy and desirable product in South Florida, the logic is that they can duplicate it in other markets.

Onx Homes’ concrete walls and steel roofs can withstand 175 mile-per-hour winds, more than a category 5 hurricane. The steel roofs are more energy efficient than their wooden alternatives thanks to their ability to reflect sunlight and reduce cooling costs.

Onx Homes uses 35 proprietary technologies, from building materials to construction techniques, that may drive prices up, Bhardwaj said. But there are savings that can be found elsewhere that ultimately benefit the consumer. Buyers can save with lower insurance costs and energy bills, and from eliminating some regular maintenance that isn’t needed with Onx Homes’ steel roofs and concrete walls meant to last more than 100 years.

As production at Onx Homes’ X+ Systems factory in Pompano Beach ramps up and the company’s new factory in Central Texas comes online, Bhardwaj sees Onx Homes expanding across the country’s southwestern states at first, followed by a nationwide roll out.

The company’s Texas plant will be open in the next few months and it will be building homes before the end of the year, Bhardwaj said.

“Then we are looking at California, Nevada and Arizona. And these are short-term goals. Our long-term goal is to be a national builder,” he said.